VAT Penalties and Interest

HMRC has introduced new penalties for late submissions or overdue VAT liability payments. These new rules apply to all the VAT accounting periods that start on or after 1 January 2023.

This new approach to VAT was introduced to bring it in line with the Income Tax Self-Assessment (ITSA) and to provide consistency across different taxes. The new point-based penalty system is designed to penalise those who regularly fail to file and pay their VAT liability on time, while being more tolerant of those who make occasional slip-ups. This will make it easier for clients to comply with their submission and payment obligations - and makes late payment penalties more proportionate to the lateness of the payment. If you cannot pay your liability on time, you can get support from HMRC by calling their Payment Support Service.

Late Payment Interest

Now, if you pay your VAT liability late, an interest will be charged on the outstanding liability from the “first day the payment is overdue” to the day you pay the liability in full. If the payment is overdue for more than 15 days, then a “Late Payment Penalty” will be added to the VAT liability and an interest will be charged on that.

The interest rate is calculated as “Bank of England Base Rate” plus 2.5%.

Note: Even if you have a “Time To Pay” arrangement to repay your VAT liabilities, HMRC will charge interest on the TTP payments until the VAT liability is paid in full.

Late Payment Penalties

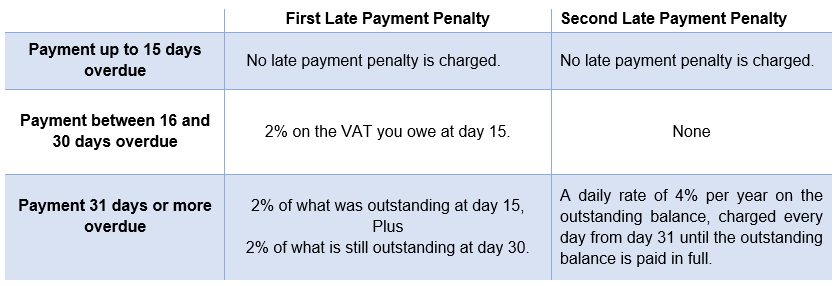

Late payment penalties can be applied to any VAT liability that is not paid in full by due date. The sooner you pay your liability, the lower the penalty amount will be. In the table below, you can find a summary on how the late payment penalty is calculated.

How to avoid tax penalties

Note: if you don’t keep to the conditions of your arranged TTP with HMRC at any point, it may be cancelled. If this happens, HMRC will charge both first and second late payment penalties as if the TTP never existed. Late payment penalties can be appealed through the Digital Tax account by you or your authorised agent.

HMRC is allowing a period of familiarisation - meaning that you will not be charged the First Payment Penalty if you pay your VAT liability or arrange a TTP within 30 days of the payment due date. This period ends on 31 December 2023, giving businesses time to get used to the new system.

Penalties if you submit your VAT Return late

From 1 January 2023, you will be penalised for late VAT submissions, even if the return is nil, or you are submitting a VAT reclaim. Penalties regarding the late submission work on a “Point-Based” system - meaning with each late submission you will receive a penalty point until you reach the penalty point threshold. When you reach the threshold, you will receive a financial penalty of £200. You will receive a further £200 penalty for each subsequent late submission while you are at the threshold.

The point threshold is set by the VAT accounting period (for both standard and non-standard periods), as follows:

If you agree with HMRC to change the accounting period, they will adjust the existing penalty points as follows:

Note: HMRC will set your points to zero if the adjustment gives you a minus figure, and if you don’t have any penalty points then they will not make any adjustments.

How and when the points are removed

Any point total can be reset to zero at any time once you have met two conditions:

Condition 1:

This is known as the period of compliance and demonstrates good behaviour. To meet the criteria, you should submit your returns on or before the due date for a period based on your submission frequency:

Condition 2:

All the VAT Returns that were due within the previous 24 months have been received (regardless of payment) by HMRC.

Note: if your points total is under the threshold, each individual point will automatically expire after 24 months.

Repayment Interest

Starting from 1 January 2023, HMRC will pay you interest on any VAT that you are owed from the day after the due date or date of submission (whichever is later), until the date that a repayment is scheduled by HMRC.

The interest is calculated at the “Bank of England Base Rate minus 1%” (with a minimum rate of 0.5%)

Useful Links

https://www.gov.uk/guidance/penalty-points-and-penalties-if-you-submit-your-vat-return-late

https://www.gov.uk/guidance/how-late-payment-penalties-work-if-you-pay-vat-late

https://www.gov.uk/guidance/late-payment-interest-if-you-do-not-pay-vat-or-penalties-on-time

https://www.gov.uk/guidance/repayment-interest-on-vat-credits-or-overpayments